How do you know what inventory of domestic content options is available and at what price for different delivery quarters?

In part two of our Domestic Content 101 blog series, we’re diving into the latest domestic solar module pricing trends and outlook on the new U.S.-manufactured product options in 2025 and 2026. Will costs for domestic content drop as more options become available, or will premium prices hold steady?

2024 domestic content pricing trends

As we mentioned in part one of this series, the updated domestic content calculation method from May 2024 has simplified qualifying for a 10% bonus on the Production Tax Credit (PTC) or Investment Tax Credit (ITC) when using U.S.-manufactured components, especially solar cells. This shift has continued to increase U.S.-based production capacity as manufacturers rush to meet rising demand for domestically produced solar components.

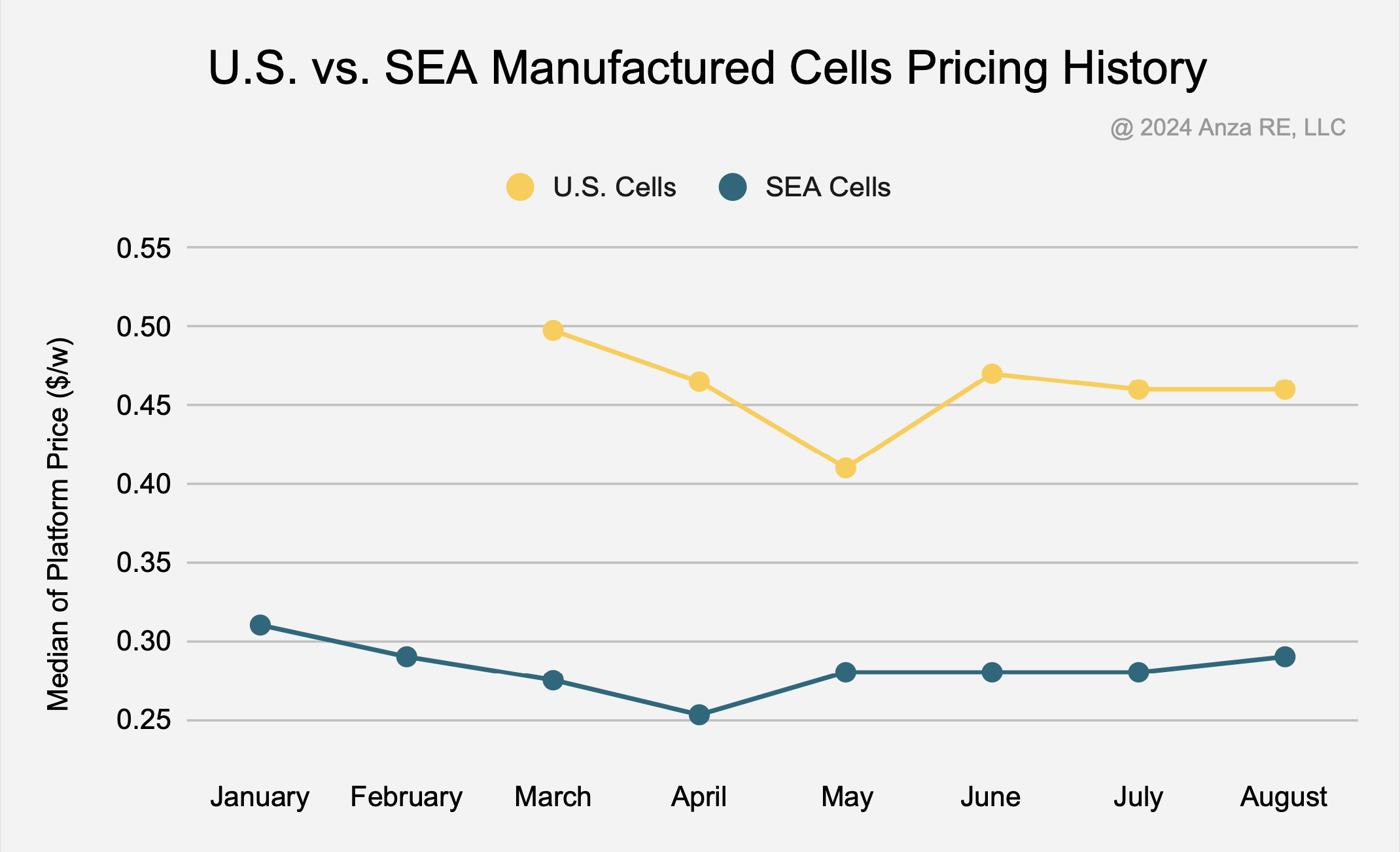

So far in 2024, this acceleration of U.S. manufacturing appears to be reshaping market pricing. Our Q3 Solar Module Pricing Insights Report shows a reduction of 4 cents from March to August 2024 or a 7.5% decrease in U.S.-manufactured cell pricing.

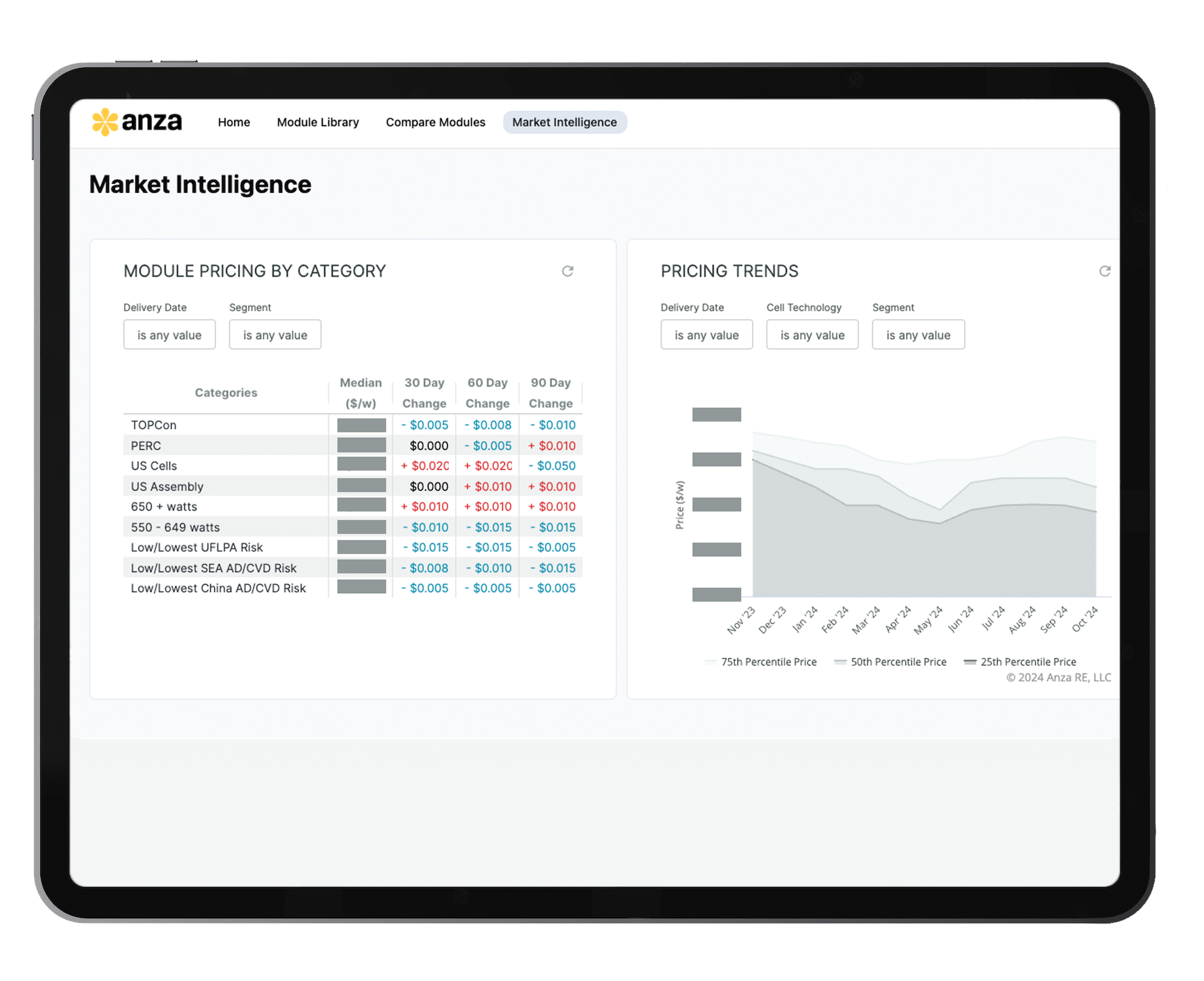

Within the Anza platform, Pro users can access up-to-date market intelligence, with median pricing changes over the last 30, 60, and 90 days for U.S. cells and U.S. assembly. As additional U.S. manufactured options and capacity enter the market in 2025 and 2026, we’re watching closely to see if the price gap between domestic and international modules will start to close. Keeping an eye on these trends can help you stay a step ahead of the curve as the market evolves.

U.S. solar module availability in 2025

News continues to roll in on plans for additional U.S. solar manufacturing and assembly facilities, including announcements and openings from Heliene, Imperial Star Solar, Canadian Solar, and more. First Solar officially opened its 3.5 GW solar panel factory in Alabama this September, and operations are set to ramp up to nearly 11 GW. This is another huge step forward in domestic manufacturing for the solar industry.

While the U.S. manufacturing announcements mentioned above paint a picture of sizable new supplies of domestically manufactured content, it’s essential to note timelines for facility openings frequently change, face delays, or are even put on hold. Additionally, much of the announced capacity (particularly for U.S. cells) was quickly purchased by eager buyers, resulting in a lack of availability for the next several quarters of some of the higher profile options. Gaining a clear view of obtainable options can be a time-intensive process. How do you know what U.S.-made solar modules are still available, when new options will enter the market, and what pricing to expect?

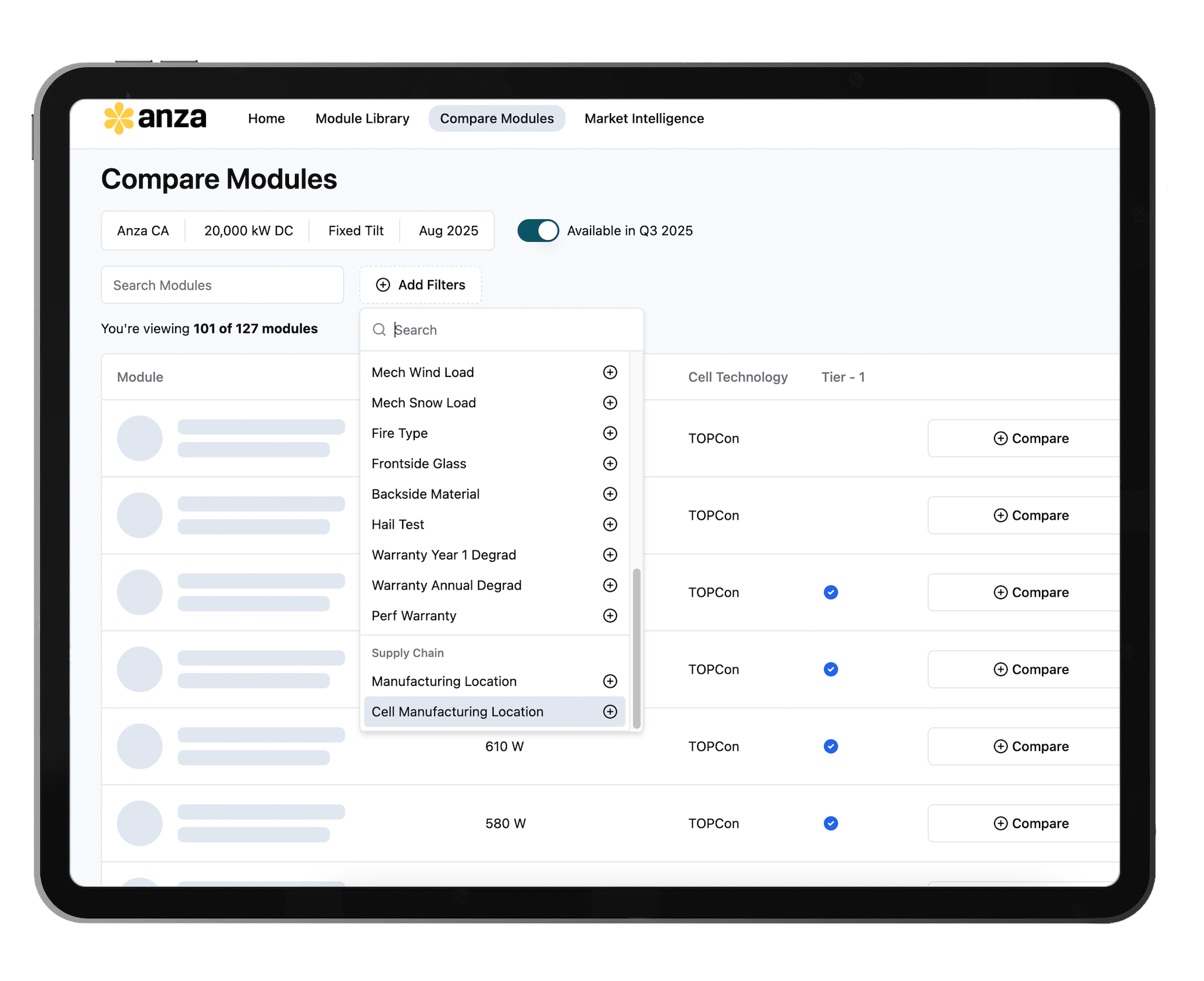

The Anza platform makes it easy for you to answer your domestic content-related solar module questions. Filter and find options in a few clicks instead of spending weeks reaching out to suppliers and piecing together insights. With up-to-date information directly from manufacturers on pricing and availability updated every two weeks or less, you’ll know exactly what domestic content options will be available for your upcoming projects or designs in seconds.

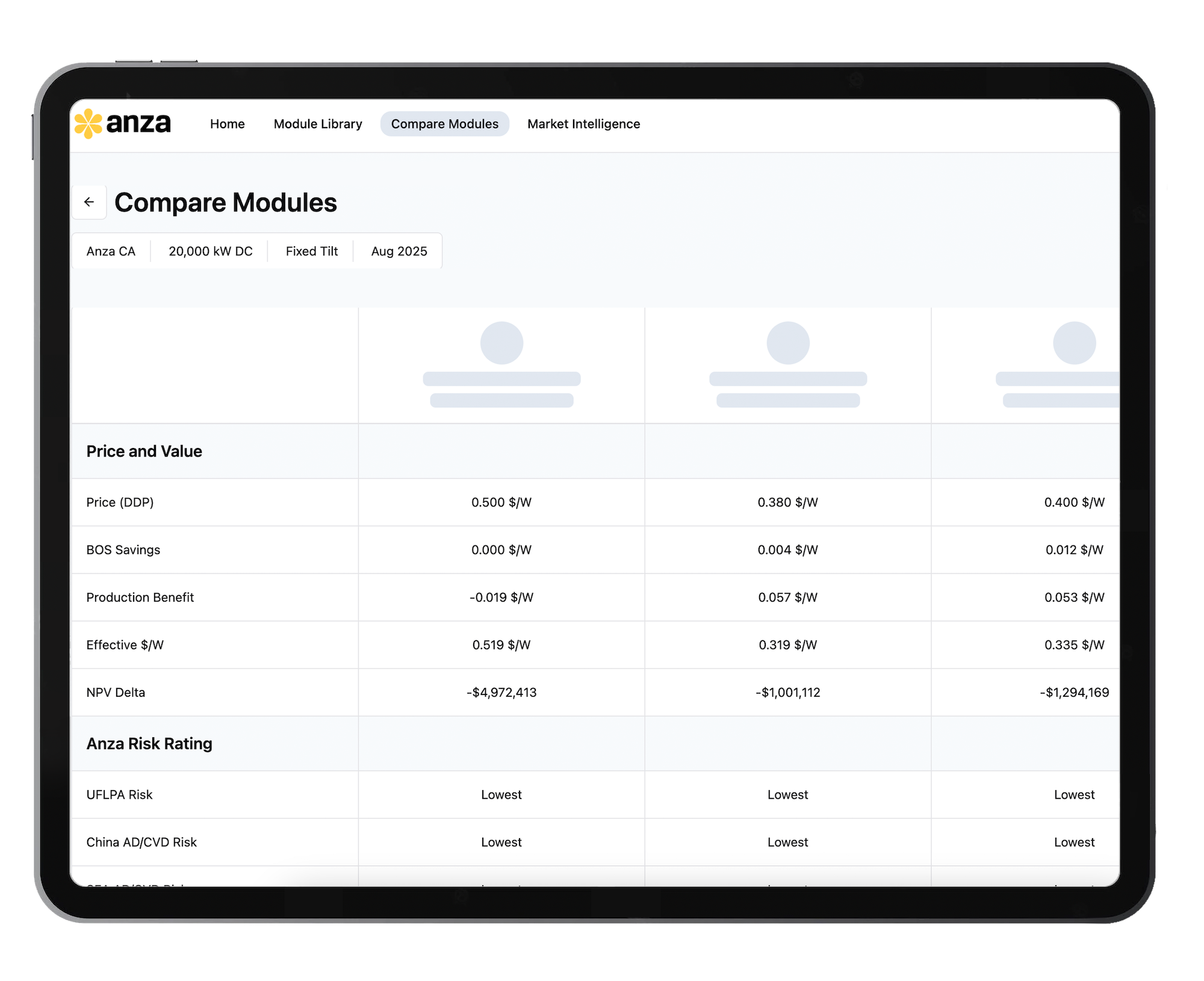

The broad range of available module options in the Anza platform can help you find domestic content options you may otherwise not know. Take, for example, this 20 MW example project in Anza, California. With a delivery date of Q3 2025, how many options that may qualify as domestic content are available for this project?

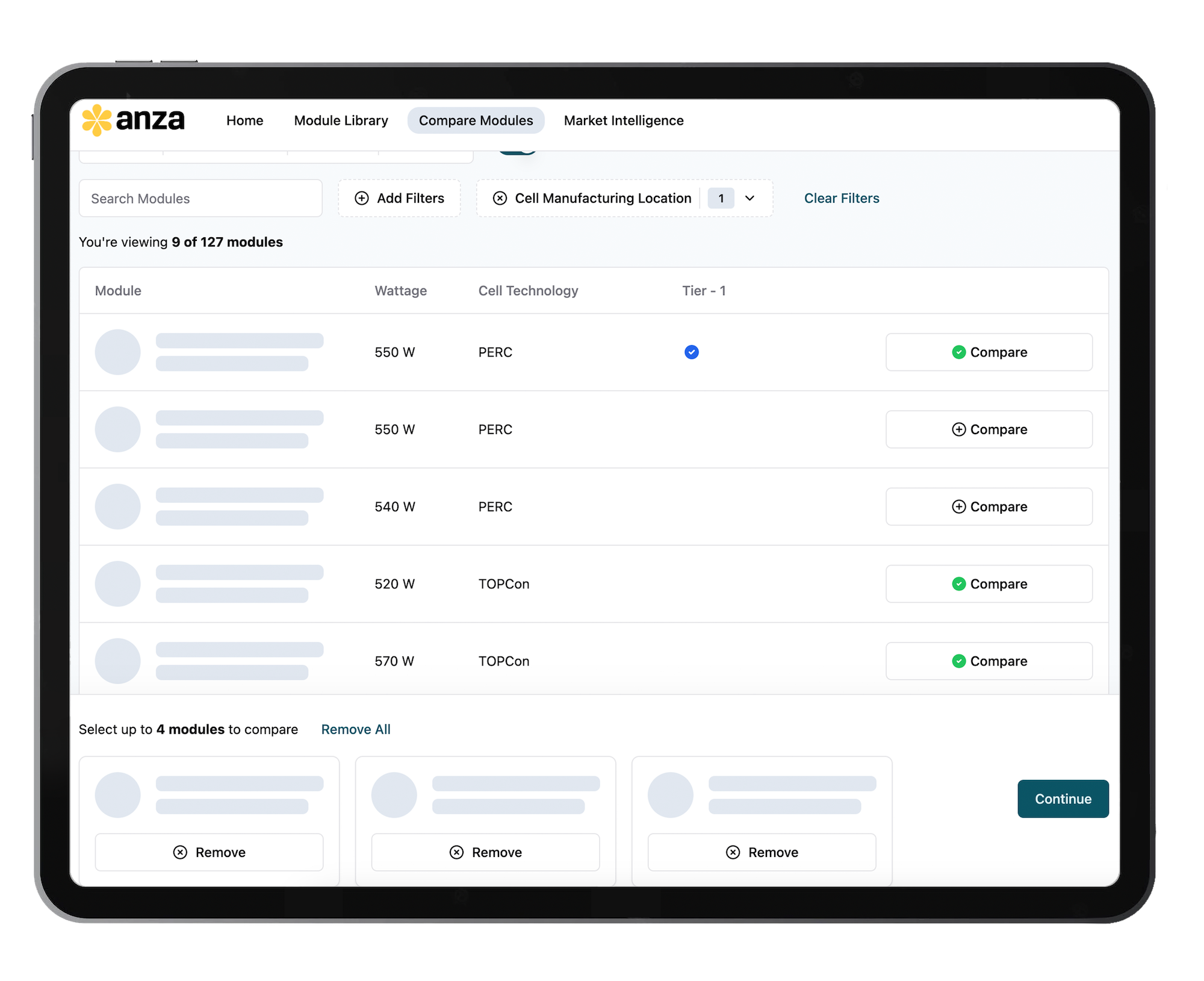

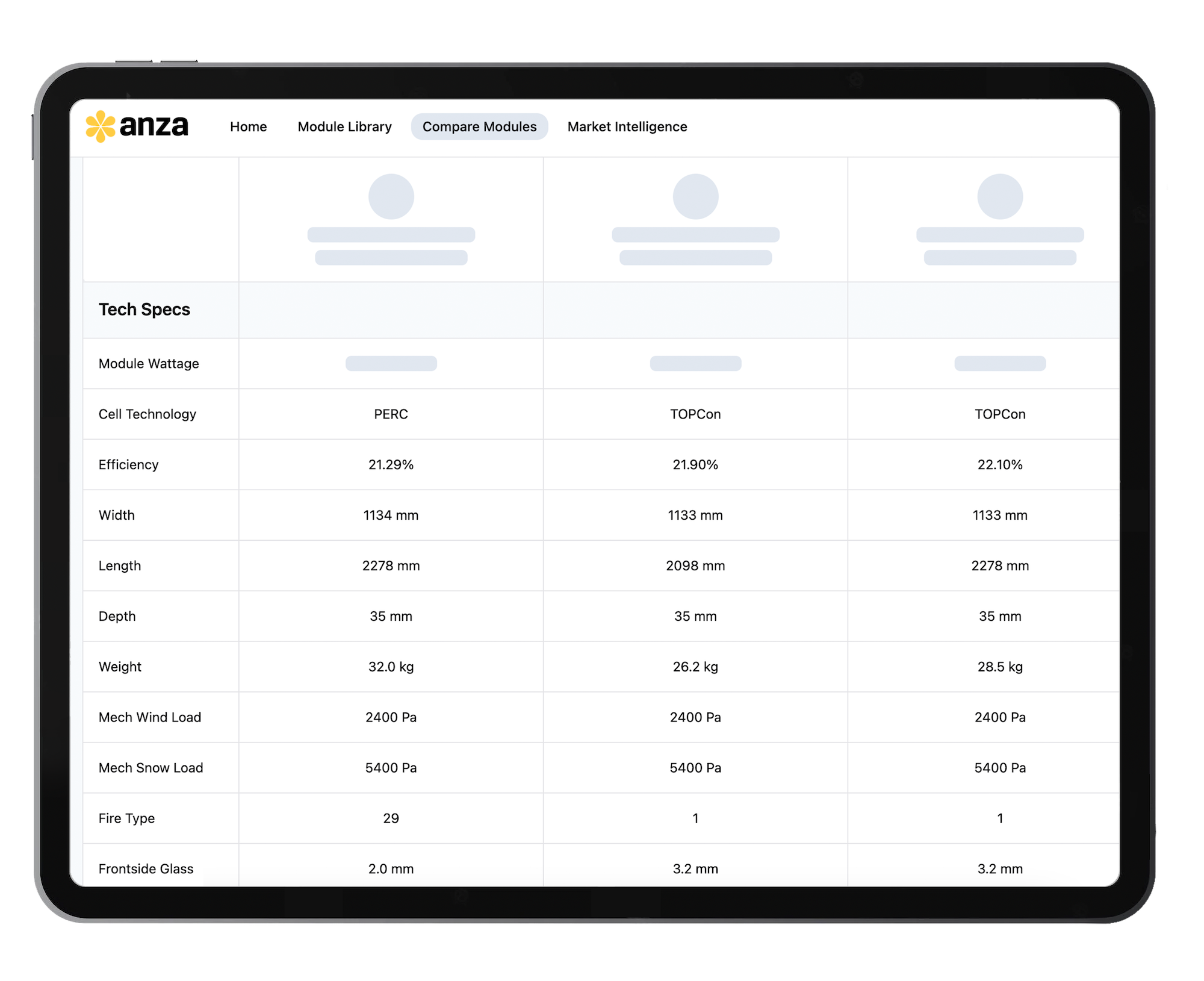

After filtering for a U.S. cell manufacturing location, the number of available options narrows down from 127 module options to 9. Within the Anza platform, you can easily see supplier information, wattage, cell technology, and Tier-1 status, and select up to four module options to compare and explore additional details.

You can quickly see list pricing information and gain access to all the documents, technical specs, and energy production information you need – all in one place. From PAN files available for download to GCR, hail test ratings, and warranty information, you no longer have to worry about tracking down data to find a domestic content option that meets your project requirements.

Only Anza has the pricing, availability, and technical data to help you know exactly what domestic content options are available for your development planning and procurement. Whether you’re focused on securing domestic content to minimize trade risk and take advantage of bonus credit or you’re open to potentially lower cost international options, Anza’s reliable data on 125+ modules from across the market ensures you have access to all the data you need to make an informed decision and determine whether domestic content is a more valuable choice.

Schedule a demo today and access the domestic content data you need to optimize your development and procurement decisions.

Anza RE, LLC and its affiliates, officers, directors, and employees (collectively “Anza”) provides this content (the “Content”) for informational purposes only and does not guarantee the accuracy or completeness of this information, which is subject to change without notice. As the Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, accounting, financial, or other advice. Nothing herein shall constitute or be construed as an offering of financial instruments or as investment advice or recommendations by Anza of an investment or other strategy (e.g., whether or not to “buy”, “sell”, or “hold” an investment). The Content is provided as-is and without warranties of any kind. You bear all risks associated with the use of the Content and ANZA DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ALL WARRANTIES OF TITLE, NON-INFRINGEMENT, ACCURACY, COMPLETENESS, USEFULNESS, MERCHANTABILITY, AND FITNESS FOR A PARTICULAR USE, AND WARRANTIES THAT MAY ARISE FROM COURSE OF DEALING/PERFORMANCE OR USAGE OF TRADE. YOUR EXCLUSIVE REMEDY FOR DISSATISFACTION WITH CONTENT IS TO STOP USING THE CONTENT. ANZA IS NOT LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, CONSEQUENTIAL, SPECIAL OR PUNITIVE DAMAGES, UNDER ANY THEORY OF LIABILITY, INCLUDING WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, USE, DATA, OR LOSS OF OTHER INTANGIBLES. IN PARTICULAR, AND WITHOUT LIMITATION, ANZA WILL NOT BE LIABLE FOR DAMAGES OF ANY KIND RESULTING FROM YOUR USE OF OR INABILITY TO USE THE CONTENT.