Need help trying to keep up with the latest guidance for the domestic content bonus credit and determining what your domestic content strategy is?

Welcome to our new blog series, helping you get up to speed on domestic content for solar and storage projects, and answering the hard questions of how to incorporate it in your development and procurement strategies. Since establishing the domestic content bonus credit as part of the 2022 Inflation Reduction Act, the government has provided multiple rounds of guidance on how to qualify for this incentive. While we still await the final proposed rules, now is the time to ensure you understand the current guidance and keep an eye on potential changes as you plan upcoming projects.

What is the domestic content bonus tax credit?

The 2022 Inflation Reduction Act established an additional 10 percent tax credit beyond the Investment Tax Credit (ITC) and the Production Tax Credit (PTC) for projects that satisfy requirements for domestically manufactured materials. This tax credit aims to encourage investment into the U.S. supply chain while supporting larger goals for deploying renewable energy, a win-win for manufacturers and solar development in the United States.

In May 2023, the IRS and the Department of the Treasury issued initial guidance for the bonus credit qualification requirements. In addition to satisfying the prevailing wage and apprenticeship requirements from the IRA, a percentage of total manufactured product costs from domestic components (steel, iron, and manufactured products) are required for an energy project to qualify for the bonus credit. This percentage increases over the coming years:

| Commencement of Construction Year | Domestic Content Percentage |

| 2024 | 40% |

| 2025 | 45% |

| 2026 | 50% |

| 2027 and beyond | 55% |

This initial guidance required taxpayers to determine the direct cost (materials and labor) to produce the product and what percentage of those costs came from domestic components. Tracking and documenting sensitive cost details from OEMs for the various structural components that make up a solar or storage project proved to be a detailed and time-consuming process. Often, companies struggled to determine (or convince their finance parties) whether their projects qualified for the requirements and may have missed out on taking advantage of this bonus credit.

Simplified elective safe harbor domestic content calculations

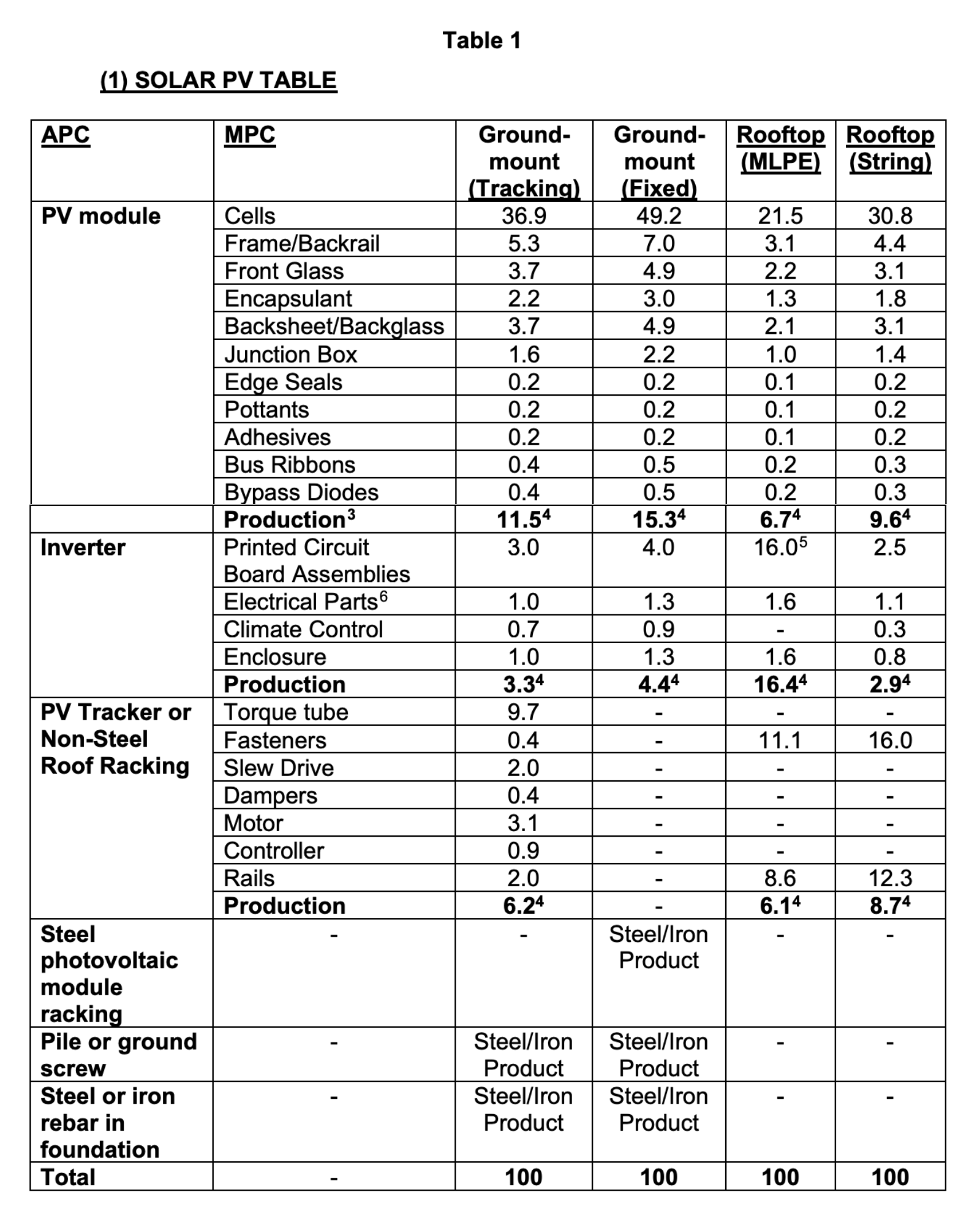

In May 2024, the government issued new guidance known as the elective safe harbor rule, helping to ease the burden on companies looking to qualify for the domestic content bonus credit. This update simplified the calculation methodology, providing component cost percentages for different types of solar projects (fixed, tracking, rooftop) and energy storage projects (grid-scale and distributed).

Instead of tracking down actual costs from manufacturers to use in domestic content calculations, solar developers can rely on the cost percentages provided by the IRS, adding up the component percentages to determine if a project will meet the total domestic content percentage requirement. Steel or iron used in these projects must be 100% domestically produced for the energy project to qualify as domestic content. Beyond that requirement, the remaining domestic content materials must add up to at least 40% of project costs (increasing to 45% in 2025).

A portion of Table 1—New Elective Safe Harbor provided in the Domestic Content Safe Harbor Notice from the IRS.

Nuances to consider: domestic vs. non-domestic options

While the safe harbor rule and table, which provide a simplified method for determining the percentage of domestic content in a solar project, is a significant improvement from the previous complex and time-consuming direct cost calculations, the process is still not without its challenges. Many solar developers and module buyers may find it difficult to navigate the nuances of domestic content vs non-domestic content options. Determining the right combination of products to qualify for the bonus credit and assessing if the added costs from purchasing domestic content ultimately create more value over the course of the project is a complex task.

As shown in the table above, an additional production percentage is applied if all manufactured product components (MPC) in an assembly (e.g., PV module, inverter, tracker or racking) are domestically produced. As the percentage of domestic content required continues to increase to 45% in 2025 and 50% in 2026, the added production percentage for inverters and/or trackers can make a difference in projects qualifying for the domestic content bonus credit.

Additionally, processes for solar + storage projects will soon change. Through the end of 2024, solar + storage projects are treated as one energy project for domestic content requirements. Depending on the mix of product options utilized, companies may qualify for the 10% domestic content bonus credit across the entire project via either the solar or storage portion of the project.

Starting in 2025, the proposed technology-neutral ITC and PTC is set to go into effect, allowing for additional technology types to qualify for these clean energy tax incentives. With this change, experts believe each technology (solar, storage, wind, hydropower, etc.) is considered separately for ITC, PTC, and domestic content. For solar + storage projects, each technology (solar and storage) will need to qualify for the domestic content bonus separately. This changes the strategy many companies are taking for their combined solar + storage projects, taking away the flexibility that came from these being viewed as one energy project for tax benefits.

Some companies are taking steps to officially commence construction on projects in 2024 to qualify both the solar and storage sides of their project without having to qualify both individually. This can be done in two different ways: 1) via the physical work rule, where “physical work of a significant nature” begins on the project, or 2) via the 5% rule, where a company “incurs five percent or more of the total cost of the energy property.” Depending on the project size, this strategy can result in savings of six or seven figures, significantly improving the project’s overall value.

Looking ahead to 2025: upcoming changes & unknowns

While most experts believe that the final domestic content rules will largely remain unchanged from the May 2024 guidance, crucial changes could come in the final proposal or through requests for comment. With recently proposed legislation pushing to avoid tax credits going to Chinese companies, there are murmurs in the market of an additional wafer requirement going into the final domestic content requirements. These stirrings in the market, coupled with market uncertainty from the upcoming presidential election, have some companies hesitant to rely on the interim guidance for what may qualify as domestic content for projects in 2025 and beyond. That said, companies can rely upon the current guidance provided they commence construction on their projects within 90 days of the subsequent publishing of updated guidance or final regulations.

The availability of domestic wafers looks to be limited for years to come as domestic manufacturing ramps up. QCells’ facility in Georgia is the only known domestic wafer manufacturer at this time. If a domestic wafer requirement is added to the final guidance without an extended transitional period before going into effect, the number of solar projects qualifying for domestic content could be drastically limited.

No matter how the final domestic content requirements play out, Anza has our finger on the pulse of domestic content and the expertise to help you stay updated as things change. Our platform lets you quickly filter for available domestic content and compare price and value to international options. We can help you find product options that work best for your project based on your timeline and get the best terms and pricing as the market evolves.

Want to see how we holistically compare domestic and international module options based on price and lifetime value? Want to see what domestic options are available for 2025 delivery?

Anza RE, LLC and its affiliates, officers, directors, and employees (collectively “Anza”) provides this content (the “Content”) for informational purposes only and does not guarantee the accuracy or completeness of this information, which is subject to change without notice. As the Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, accounting, financial, or other advice. Nothing herein shall constitute or be construed as an offering of financial instruments or as investment advice or recommendations by Anza of an investment or other strategy (e.g., whether or not to “buy”, “sell”, or “hold” an investment). The Content is provided as-is and without warranties of any kind. You bear all risks associated with the use of the Content and ANZA DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ALL WARRANTIES OF TITLE, NON-INFRINGEMENT, ACCURACY, COMPLETENESS, USEFULNESS, MERCHANTABILITY, AND FITNESS FOR A PARTICULAR USE, AND WARRANTIES THAT MAY ARISE FROM COURSE OF DEALING/PERFORMANCE OR USAGE OF TRADE. YOUR EXCLUSIVE REMEDY FOR DISSATISFACTION WITH CONTENT IS TO STOP USING THE CONTENT. ANZA IS NOT LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, CONSEQUENTIAL, SPECIAL OR PUNITIVE DAMAGES, UNDER ANY THEORY OF LIABILITY, INCLUDING WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, USE, DATA, OR LOSS OF OTHER INTANGIBLES. IN PARTICULAR, AND WITHOUT LIMITATION, ANZA WILL NOT BE LIABLE FOR DAMAGES OF ANY KIND RESULTING FROM YOUR USE OF OR INABILITY TO USE THE CONTENT.